It seems that the small glimmer of hope that everyone is hoping for in the housing market is not likely to come anytime soon. Mathew Padilla has posted an excellent blog article discussing that the discussion of another wave of foreclosure implies that the current wave has already receded. Sam Khater, a senior economist with First American CoreLogic has stated: “To say there is a second wave implies the (current) wave has receded . . . I don’t see that the wave has receded.”

Call it what you will, the next foreclosure wave to hit will largely involve Pay Option ARMs. Pay Option ARMs are adjustable rate mortgages on which the interest rate adjusts monthly and the payment adjusts annually, with borrowers offered options on how large a payment they will make. The options include interest-only, and a "minimum" payment that is usually less than the interest-only payment. The minimum payment option results in a growing loan balance, termed "negative amortization." As Long and Foster’s Ron Sitrin recently commented: because these loans "had negative amortization for so long, they can’t refinance out of them and they cannot sell them because the loans are worth more than the properties themselves."

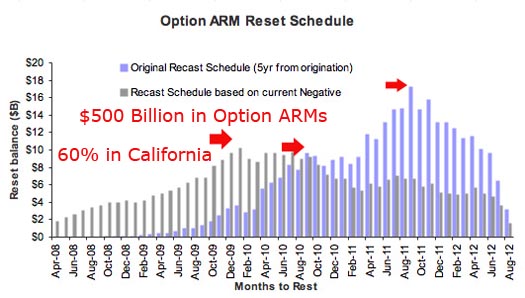

For the most part the expensive gated communities have avoided the impact of the current foreclosure wave, but its job loss consequences are coming home to roost in the upper income brackets. This graph puts the Pay Option ARM problem in stark terms:

As a recent post on Dr. Housing Bubble stated: "The Pay Option ARM is one of the most poorly construed mortgage product ever to face this planet. It was a pathetic attempt to allow a larger majority of Americans to have a piece of the great American credit ponzi scheme." How’s that for upbeat?